Get a quote on car insurance online is now easier than ever. This guide walks you through the entire process, from understanding your options to ensuring a secure and convenient experience. We’ll explore the user journey, compare providers, and examine the benefits of online quoting. Crucially, we’ll address potential pitfalls and highlight the importance of a smooth, mobile-friendly experience.

We’ll also cover security and privacy concerns, essential elements of a user-friendly interface, and integrations with other services. Understanding these aspects is vital for making an informed decision. Finally, we’ll discuss customer support and assistance, ensuring you have the help you need throughout the process.

Understanding the User Journey

Securing a car insurance quote online is a common and increasingly popular process. This involves a series of steps, influenced by various factors and potential pain points. Understanding the user journey is crucial for optimizing the online experience and driving positive outcomes.

Typical Steps in the Online Quote Process

The typical user journey for obtaining a car insurance quote online usually begins with a search for a suitable provider. Users then enter details about their vehicle, driving history, and personal information. Next, they compare quotes from different insurers, and finally, they complete the application process.

Pain Points in the Online Process

Users often encounter challenges during the quote process. A lack of transparency in pricing or hidden fees can be frustrating. Complex input forms or a confusing website layout can deter users. The inability to readily compare quotes from multiple insurers effectively can create additional difficulty. Additionally, a lengthy application process can be a significant pain point.

Factors Influencing Online Quote Decisions

Several factors influence a user’s decision to obtain a quote online. Price competitiveness is paramount, with users actively seeking the most favorable rates. Ease of use and a streamlined online experience are highly valued. The ability to compare quotes instantly and conveniently is a significant driver. Furthermore, positive online reviews and the perceived reliability of the insurer play a crucial role.

Users may also be motivated by the time-saving aspect of online quoting compared to in-person interactions.

Flowchart of the User Journey

A user’s journey to obtain an online car insurance quote can be visualized as follows:

Start | V [Search for insurance provider] | V [Enter vehicle details] | V [Enter driving history & personal information] | V [Compare quotes from multiple providers] | V [Complete the application] | V [Receive quote & potentially apply] | V End

Comparison of Online Quote Providers

Source: autocheatsheet.com

Finding the best car insurance online involves comparing various providers.

Each platform offers different features and services, impacting the overall user experience and final cost. Understanding these nuances is crucial for making an informed decision.

Online car insurance providers leverage technology to streamline the process, but the variations in their approaches can lead to significant differences in the quotes and services they offer. This comparison delves into the key distinctions, providing insight into the features, pricing models, and factors that influence consumer choices.

Differences in Features and Services

Various online providers cater to specific needs and preferences. Some might excel in providing comprehensive coverage options, while others prioritize ease of use or specialized services like roadside assistance. Features like bundled services, discounts, and mobile apps vary across providers, influencing the user experience and value proposition.

Comparison of Pricing Models

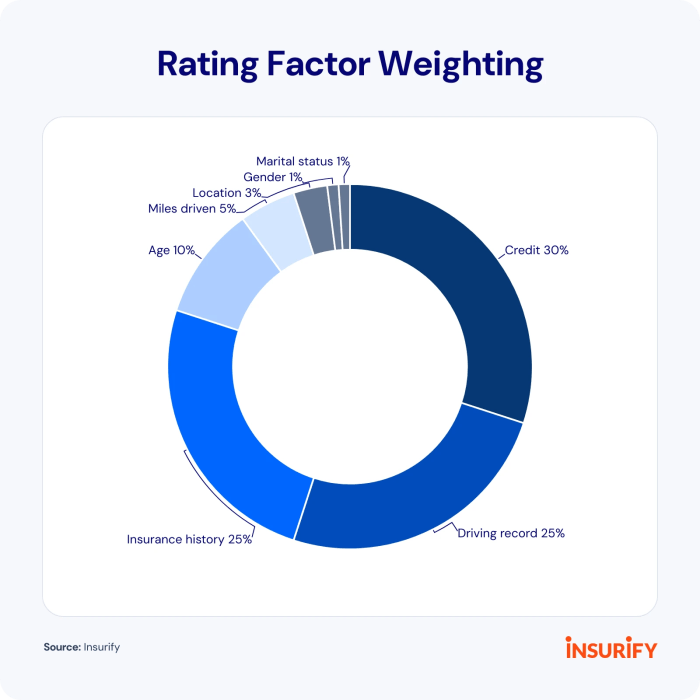

Pricing models used by online car insurance providers differ significantly. Some providers use a straightforward, transparent pricing structure based on factors like age, location, and driving history. Others might employ complex algorithms that consider a wider range of variables, potentially leading to more personalized but less transparent pricing. This variability in pricing methodologies needs careful consideration by the consumer.

Factors Influencing User Choice

User choice is influenced by a complex interplay of factors. These include the level of coverage required, the specific features valued by the individual, and the overall user experience offered by each provider. The transparency of pricing, the ease of the online application process, and the availability of customer support also contribute to the decision-making process.

Table Comparing Three Major Online Car Insurance Providers

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Coverage Options | Comprehensive, collision, liability; includes add-ons like roadside assistance. | Comprehensive, collision, liability; limited add-on options. | Comprehensive, collision, liability; extensive add-ons, including rental car insurance. |

| Pricing Model | Transparent, clearly displays factors influencing premiums. | Semi-transparent, requires detailed review to understand pricing elements. | Data-driven, complex algorithm; personalized pricing based on extensive data. |

| Customer Reviews | High ratings for ease of use and quick quotes. | Mixed reviews, some praising customer service, others highlighting complexity in the process. | Generally positive reviews for coverage breadth, but some report difficulty in accessing support. |

| Ease of Use | Excellent online platform; intuitive interface. | Good online platform; minor usability issues. | Modern platform, but some users report a steep learning curve. |

| Discounts Offered | Multiple discounts, including safe driving programs. | Limited discounts; primarily focused on safe driving programs. | Extensive discounts, including multi-car discounts and student discounts. |

Features and Benefits of Online Quotes

Getting a car insurance quote online offers numerous advantages over traditional methods. It streamlines the process, saving you valuable time and effort while providing a wide array of options to compare. This ease of access, combined with competitive pricing, makes online quoting a popular choice for consumers seeking the best insurance value.

Online quote platforms have become incredibly sophisticated, simplifying the entire process from initial information gathering to final quote comparisons. This efficiency is facilitated by user-friendly interfaces and intelligent algorithms designed to expedite the quote generation process.

Convenience and Speed

Online quoting platforms provide instant access to insurance quotes, eliminating the need for phone calls or in-person visits. This immediate feedback allows you to compare multiple options from various providers quickly. This instant gratification factor is a significant benefit in a fast-paced world.

Comparison Capabilities

A key advantage of online quoting is the ability to compare quotes from multiple insurance providers simultaneously. This comprehensive comparison feature empowers you to make well-informed decisions by analyzing different coverage options and premiums. You can see exactly how different providers’ policies stack up against each other, making your choice much clearer.

Detailed Information Gathering

Online quoting platforms employ sophisticated tools to gather the necessary information. This often includes online forms, where you enter vehicle details, driving history, and other relevant information. These forms are designed to be intuitive and user-friendly, reducing the potential for errors and ensuring accuracy in the quoting process.

Examples of Online Tools and Functionalities

- Vehicle Information Forms: These forms often incorporate drop-down menus, radio buttons, and input fields to capture precise vehicle specifications, including make, model, year, and VIN. This data is critical for accurate premium calculation.

- Driving History Input: Some platforms provide interactive sections for inputting your driving record. This might involve a simple yes/no response to whether you’ve had any accidents or violations. This data is directly integrated into the algorithms to assess your risk profile.

- Coverage Options: These platforms offer various coverage options, allowing you to select the specific protections you need. Options for liability, collision, comprehensive, and uninsured/underinsured motorist coverage are frequently presented, offering a comprehensive view of available choices.

Time and Effort Savings

Online quoting platforms are designed to minimize the time and effort required to obtain quotes. By automating the information gathering and comparison process, these platforms allow you to compare multiple options in a fraction of the time it would take to contact each provider individually. This streamlined approach significantly reduces the administrative burden.

Examples of Time Savings

Comparing quotes from 5 different insurers could take hours or even days if done manually. Online tools complete this process in minutes.

- Elimination of phone calls and emails: The process is entirely online, removing the need to interact with multiple customer service representatives.

- Automated quote generation: Insurance companies use sophisticated algorithms to generate quotes instantly, providing users with real-time comparisons.

Factors Influencing Quote Accuracy: Get A Quote On Car Insurance Online

Source: carquotesbyzip.com

Online car insurance quotes are a convenient way to compare coverage options, but the accuracy of these quotes depends on several key factors. Understanding these factors allows users to get a more precise and reliable estimate of their insurance premiums. Incorrect information inputted can lead to inaccurate quotes and potentially higher costs than necessary.

Accurate quotes are crucial for informed decision-making. A quote that is too low might not adequately protect the user’s financial interests, while a quote that is too high may lead to unnecessary expenses. By understanding the influences on quote accuracy, users can ensure they’re receiving a fair and representative estimate.

Importance of Accurate Information

Providing accurate information is paramount in obtaining a precise car insurance quote. Insurance companies use this data to assess risk and calculate premiums. Inaccuracies can significantly impact the quote, leading to either an overestimation or underestimation of the actual cost of coverage. This can result in users paying more than necessary or having insufficient coverage. Examples include incorrectly stating vehicle year, mileage, or driving history.

User’s Personal Circumstances

Personal circumstances, such as age, location, and driving record, are critical factors considered in calculating insurance premiums. Insurance companies use statistical data to determine the likelihood of a claim based on these factors. For example, younger drivers typically have higher premiums due to a higher perceived risk of accidents. Location plays a role because accident rates and claims frequency can vary by region.

Vehicle Details

Vehicle details significantly impact quote accuracy. Factors like the vehicle’s make, model, year, and safety features influence the risk assessment. High-theft-risk vehicles or those with less robust safety features may result in higher premiums. A newer model with advanced safety features, on the other hand, may lead to lower premiums.

Driving History

Driving history is a major determinant of insurance premiums. This includes any past accidents, traffic violations, or claims filed. A clean driving record generally leads to lower premiums. Accidents, speeding tickets, or at-fault incidents can increase the perceived risk, resulting in higher premiums. The severity and frequency of these events are significant considerations in calculating premiums.

A user with a history of several minor traffic violations may see a larger impact on their quote compared to a user with a single, major accident.

Security and Privacy Concerns

Getting a car insurance quote online is convenient, but it’s crucial to understand the security measures in place to protect your sensitive data. Online providers are constantly working to safeguard your information, but it’s equally important for you to be aware of potential risks and how to protect yourself.

Online car insurance providers prioritize data security through a combination of robust technology and strict policies. This includes using encryption, secure servers, and multi-factor authentication to prevent unauthorized access. Understanding these measures and your own role in maintaining security is key to a smooth and safe online quoting experience.

Security Measures Employed by Providers

Online providers employ various security measures to protect user data. These include encryption protocols, such as HTTPS, to ensure data transmitted between your device and the provider’s website is scrambled and unreadable to unauthorized parties. Secure servers, designed with robust firewall protection, further safeguard your information. These servers are often located in geographically diverse locations to minimize the impact of potential localized attacks.

Privacy Policies and Practices

Providers typically have comprehensive privacy policies outlining how they collect, use, and share your data. These policies should clearly state the categories of data collected (e.g., personal information, driving history), the purposes for collecting it (e.g., calculating premiums, fulfilling your request for a quote), and the recipients of the data (e.g., insurance companies, regulatory bodies). Understanding these policies is crucial to making informed decisions.

Potential Security Risks

While online providers take significant security precautions, potential risks exist. Phishing attempts, where malicious actors try to trick you into revealing your login credentials, are a persistent threat. Malware infections on your device could potentially compromise your data. Maintaining updated software and operating systems, along with strong passwords, is crucial in mitigating these risks. In addition, maintaining vigilance against suspicious emails or websites is essential.

Data breaches, though less common, can still happen. If you suspect a data breach, it’s important to immediately contact the insurance provider and consider changing your passwords.

Importance of Protecting Personal Information

Protecting your personal information during the online quoting process is paramount. Use strong, unique passwords for all your online accounts, avoid using easily guessed passwords, and enable two-factor authentication whenever possible. Regularly update your software and operating systems to patch security vulnerabilities. Be wary of suspicious links or websites, and never share your personal information with unverified sources.

Be mindful of the information you provide online. Verify the legitimacy of the website before entering any personal data.

Examples of Best Practices

Using a strong password, such as a combination of uppercase and lowercase letters, numbers, and symbols, is crucial. Consider using a password manager to help generate and store strong passwords securely. Regularly checking your accounts for suspicious activity and promptly reporting any issues are essential steps to maintaining security.

Mobile-Friendly Experience

Getting a car insurance quote on the go is now the norm. A seamless mobile experience is crucial for attracting and retaining customers. Users expect a streamlined process that adapts to their devices, ensuring a positive and efficient interaction. A well-designed mobile platform allows users to access and compare quotes conveniently, regardless of their location or the device they are using.

A responsive design that adjusts to various screen sizes is vital. This adaptability ensures a smooth and intuitive experience for users, regardless of whether they are using a smartphone, tablet, or a smaller screen device. The core principles of a mobile-friendly experience revolve around user-centered design, simplifying navigation, and optimizing page loading speed.

Importance of a Mobile-Optimized Design, Get a quote on car insurance online

A mobile-friendly design isn’t just a trend; it’s a necessity. Mobile devices have become the primary means of internet access for many consumers, making mobile optimization crucial for a positive user experience. A poorly designed mobile website can lead to lost customers and missed opportunities. Users are more likely to abandon a quote request if the process is cumbersome or the site isn’t optimized for their device.

A well-designed mobile experience encourages more quotes and ultimately, more sales.

User Experience and Functionalities of Mobile-Optimized Websites and Apps

Mobile-optimized websites and apps prioritize simplicity and efficiency. Navigation should be intuitive and easy to follow. Forms for inputting information should be concise and easily accessible. Images and other media should load quickly and clearly. The use of clear call-to-action buttons is critical to guiding users through the quoting process.

Real-time quote updates enhance the user experience, keeping the customer engaged and informed throughout the process.

Design Considerations for Mobile Platforms

User interface (UI) design is paramount for a positive mobile experience. Elements like buttons, text fields, and images should be sized and positioned appropriately for optimal readability and usability. The use of clear and concise language is crucial for conveying information effectively. Using high-quality images and graphics is also essential, but they should be optimized for mobile devices to ensure quick loading times.

Prioritizing visual hierarchy through strategic use of colors and typography can enhance the overall experience. The visual layout should be consistent across different screen sizes.

Responsive Design Principles for Mobile Accessibility

Responsive design is the key to a consistent and accessible mobile experience. It allows the website or app to automatically adjust its layout and functionality to fit the screen size of the device being used. This ensures that the user interface is optimal on various devices, from smartphones to tablets. Using flexible grids and fluid layouts, images that scale appropriately, and CSS media queries are crucial aspects of responsive design.

By incorporating these principles, a website can adapt to different screen resolutions and orientations, creating a seamless and intuitive experience. The end result is a site that works well on all devices, regardless of the user’s specific device or screen size.

User Interface and Experience

Source: storyblok.com

A positive user experience is paramount when it comes to online car insurance quoting. A well-designed interface not only streamlines the process but also instills confidence in the user, ultimately leading to a higher conversion rate. Intuitive navigation and clear presentation of information are key elements in achieving this goal.

User Interface Designs for Online Car Insurance Quoting

Different designs cater to diverse user preferences and needs. A crucial aspect of design is choosing the most effective format to present information, ensuring easy comprehension and minimal effort for the user.

| Design Type | Description | Example |

|---|---|---|

| Step-by-Step Wizard | Guides users through a series of logical steps, breaking down the complex process into manageable parts. | A typical example is a wizard that asks for vehicle details, driver information, and desired coverage options sequentially. |

| Tabbed Interface | Organizes different sections of the quote request into distinct tabs, allowing users to navigate between them easily. | Separating vehicle details, driver information, and coverage options into individual tabs improves organization and allows for quick access. |

| Accordion Interface | Hides less crucial information until the user explicitly expands a section, optimizing the interface for users who only need basic information. | For instance, users can choose to expand a section on add-on coverages, or read more on a specific type of insurance. |

Essential Elements of a Good User Interface

A robust online car insurance quoting platform requires careful attention to detail in its design. These elements are crucial for a smooth and efficient experience:

- Clear Navigation: Intuitive navigation allows users to easily find the information they need without getting lost in a labyrinthine layout. A well-structured site map and logical organization of content are vital for this.

- Informative Input Fields: Providing clear instructions and examples within the input fields helps users avoid errors and ensure accurate data entry. For example, using drop-down menus for options like vehicle type or coverage level reduces potential errors.

- Visual Cues: Visual elements like clear labels, icons, and progress bars provide visual cues, guiding users through the quoting process and highlighting key steps. These cues create a more user-friendly and less daunting experience.

- Responsive Design: The website should adapt to different screen sizes and devices, ensuring a consistent and seamless experience across desktops, tablets, and mobile phones.

Importance of Clear and Concise Language

Clear and concise language significantly enhances the user experience. Ambiguity or overly technical jargon can lead to confusion and errors.

“Simple, direct language reduces the likelihood of misunderstandings, leading to a more positive user experience.”

Using plain language, avoiding complex terminology, and offering clear explanations for each step in the quoting process are crucial aspects.

Factors Contributing to a Positive User Experience

Several factors contribute to a positive user experience during the online quoting process:

- Fast Loading Times: A slow-loading website is frustrating. Optimized code and efficient server responses are essential for providing a quick and responsive experience.

- Accessibility: Ensuring the website is accessible to users with disabilities is essential for inclusivity and a more comprehensive user base. Compliance with accessibility guidelines is paramount.

- Error Handling: Clear error messages and guidance help users identify and correct mistakes during the quoting process, preventing frustration and ensuring data accuracy.

- Security Assurance: Instilling confidence in the security of the site and user data is vital for a smooth experience. Clear displays of security protocols and certifications build trust.

Integration with Other Services

Online car insurance quoting platforms are increasingly integrating with other services to offer a more comprehensive and convenient user experience. This integration extends beyond simply providing quotes, allowing users to manage their entire financial vehicle portfolio in one place. This seamless approach streamlines the process and enhances user satisfaction.

Integration with other services provides a unified platform for users to manage their financial affairs related to their vehicles. This is achieved by linking their insurance needs with other essential services, such as financial institutions and potentially even vehicle maintenance platforms.

Benefits for Users

Integrating with other services offers numerous benefits for users. These benefits encompass a wider range of financial and administrative tasks, ultimately saving users time and effort.

- Simplified Financial Management: Users can easily manage their entire vehicle-related finances, including insurance premiums, loan payments, and potentially even maintenance costs, all within a single platform. This holistic view simplifies the process of tracking and paying for vehicle-related expenses.

- Enhanced Convenience: Seamless integration eliminates the need to switch between different applications and websites, saving users significant time and effort. This streamlined approach fosters a more positive user experience.

- Improved Accuracy and Reduced Errors: Automating the data transfer between linked services minimizes the risk of manual errors, which can significantly impact the accuracy of financial records. This precision also helps avoid potential oversights.

- Personalized Recommendations: Integrating with financial institutions allows the platform to offer personalized financial recommendations based on the user’s financial profile and vehicle-related data. This tailored approach can help users make more informed financial decisions.

Examples of Existing Integrations

Several car insurance quoting platforms already leverage integrations with financial institutions.

- Financial Institution Partnerships: Some platforms integrate with banks and credit unions to allow users to directly pay their insurance premiums using their bank accounts. This streamlined payment process simplifies the transaction and reduces potential errors.

- Loan and Financing Integrations: Some providers may allow users to access their vehicle loan information and payment details through the platform. This feature allows users to see a comprehensive view of their vehicle-related financial commitments.

- Vehicle Maintenance Integration (Potential): While less prevalent, some platforms are exploring integrations with vehicle maintenance providers to potentially offer bundled packages for insurance, financing, and routine maintenance. This could offer a comprehensive approach to vehicle management.

Impact on User Experience

Seamless integration significantly enhances the overall user experience.

The user experience is greatly improved by the ability to manage all vehicle-related financial tasks in one location.

A well-integrated platform provides a unified and intuitive user interface, making it easier for users to manage their finances, pay bills, and access relevant information about their vehicles. This streamlined approach contributes to a more positive user experience.

Customer Support and Assistance

Getting a car insurance quote online is convenient, but reliable customer support is equally important. Users need readily available assistance if issues arise during the quoting process or if they have questions about their options. Understanding the support mechanisms in place builds trust and confidence in the online quoting platform.

Effective customer support is crucial in the online car insurance quoting process. It ensures users feel confident and empowered to make informed decisions. This support is often the deciding factor when comparing similar online quote providers.

Customer Support Channels

Online platforms often provide multiple channels for users to reach out for assistance. These channels typically include a dedicated help center, live chat, and email support. A user-friendly interface guides users to the appropriate support channel based on their need.

- Help Center: A comprehensive help center is a valuable resource for users. It often includes FAQs, articles, and tutorials covering common questions and procedures. This allows users to find solutions independently, saving time and effort.

- Live Chat: Live chat support allows users to interact with a representative in real-time. This is especially helpful for complex queries or urgent issues. Real-time assistance can offer immediate resolutions.

- Email Support: Email support provides a more structured way to communicate. This is ideal for users needing detailed information or follow-up on specific issues. It’s a good channel for complex issues requiring detailed documentation.

Types of Support and Response Times

The types of support available vary depending on the online quote provider. Some platforms might offer general inquiries, technical assistance, and account management support. Response times are crucial; users expect prompt and efficient support.

- General Inquiries: Support for general inquiries regarding the quoting process, policy information, or frequently asked questions. Expect a response within a few hours to a business day. The help center is usually the first point of contact for these.

- Technical Assistance: Support for technical issues related to the online platform or software, ensuring the platform functions properly. Technical support often has a slightly longer response time, typically a business day or more.

- Account Management Support: Assistance with account-related matters, such as policy updates, payments, or claims. Expect response times to vary depending on the complexity and type of support required, ranging from a few hours to a business day.

Role of Support in Resolving Issues

Customer support plays a critical role in resolving user issues. Effective support can significantly impact user satisfaction and loyalty. A smooth and efficient resolution process contributes to positive customer experiences.

- Issue Resolution: Support teams work to understand and resolve user issues. A well-defined process, including issue tracking and escalation procedures, is vital to resolving user problems effectively.

- Proactive Assistance: Some platforms provide proactive support by contacting users with important information, such as policy changes or account updates. This approach helps prevent potential problems.

- Feedback Collection: Customer support actively collects feedback on the platform and support services. This feedback helps the platform improve and address user needs more effectively.

Summary

In conclusion, getting a quote on car insurance online offers significant advantages in terms of convenience, time-saving, and access to a wide range of options. By understanding the steps involved, the various providers, and the factors influencing accuracy and security, you can navigate the process with confidence. Remember to prioritize a secure online experience, and don’t hesitate to utilize available customer support channels.

This comprehensive guide aims to empower you to make the best decision for your needs.

FAQ

How long does it typically take to get a car insurance quote online?

The time it takes to get a quote varies depending on the provider and the complexity of your request. However, most reputable providers aim for a quick turnaround, often within minutes.

What information do I need to get a quote?

You’ll generally need information about your vehicle (make, model, year), your driving history (claims, accidents), and your personal details (age, location, etc.).

Are online quotes always accurate?

Online quotes are typically accurate, but factors like the completeness and accuracy of the information you provide can influence the precision of the quote. Always double-check for errors before making a decision.

What security measures are in place to protect my personal data?

Reputable providers utilize industry-standard security measures, including encryption and secure servers, to safeguard your personal information.

Can I compare quotes from different providers on a single platform?

Yes, many websites act as comparison platforms, allowing you to see quotes from multiple providers at once, streamlining the comparison process.